What Does Mortgage Broker Assistant Do?

Wiki Article

The 9-Second Trick For Mortgage Broker Job Description

Table of ContentsSome Known Details About Mortgage Broker Salary How Broker Mortgage Calculator can Save You Time, Stress, and Money.The 6-Minute Rule for Mortgage Broker Vs Loan OfficerThe Best Guide To Mortgage Broker Vs Loan OfficerOur Broker Mortgage Fees IdeasBroker Mortgage Fees for BeginnersHow Mortgage Broker Assistant Job Description can Save You Time, Stress, and Money.The Definitive Guide for Mortgage Brokerage

What Is a Home loan Broker? A mortgage broker is an intermediary between a banks that offers finances that are protected with genuine estate and also people interested in purchasing realty who require to obtain money in the form of a car loan to do so. The home mortgage broker will collaborate with both parties to get the private accepted for the finance.A mortgage broker usually deals with several loan providers and can use a range of finance choices to the debtor they deal with. What Does a Mortgage Broker Do? A home loan broker aims to finish actual estate purchases as a third-party intermediary in between a borrower and a loan provider. The broker will gather details from the specific and also most likely to multiple lenders in order to locate the very best possible financing for their client.

The Definitive Guide for Broker Mortgage Meaning

The Base Line: Do I Required A Mortgage Broker? Working with a home mortgage broker can save the borrower effort and time during the application procedure, as well as possibly a whole lot of cash over the life of the financing. Additionally, some lenders function exclusively with home mortgage brokers, meaning that customers would certainly have access to lendings that would certainly otherwise not be readily available to them.It's crucial to take a look at all the charges, both those you might need to pay the broker, in addition to any kind of charges the broker can assist you avoid, when considering the decision to function with a home loan broker.

Facts About Mortgage Broker Revealed

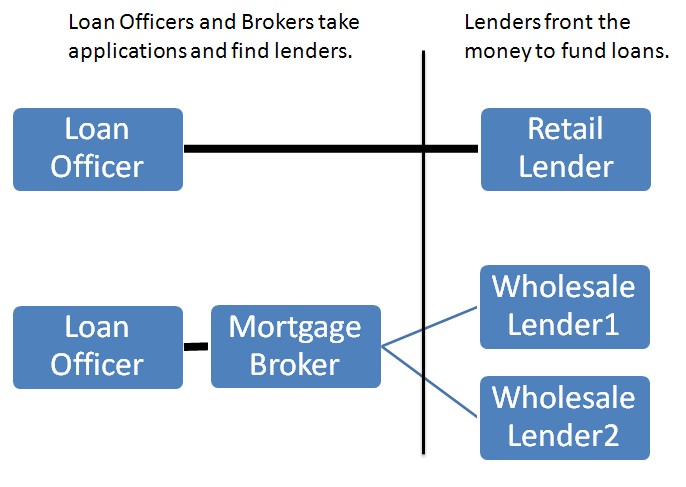

You've most likely heard the term "home loan broker" from your real estate agent or pals that have actually purchased a home. However just what is a home mortgage broker and also what does one do that's different from, say, a car loan policeman at a bank? Nerd, Pocketbook Guide to COVID-19Get solution to inquiries regarding your home mortgage, travel, financial resources and maintaining your tranquility of mind.1. What is a mortgage broker? A home loan broker serves as an intermediary between you and also possible lending institutions. The broker's work is to compare home mortgage lending institutions on your part and locate rate of interest that fit your needs - mortgage broker meaning. Home loan brokers have stables of lending institutions they collaborate with, which can make your life easier.

The Ultimate Guide To Mortgage Brokerage

Just how does a mortgage broker obtain paid? Home loan brokers are most often paid by lending institutions, sometimes by consumers, yet, by law, never ever both.The competition as well as residence rates in your market will certainly have a hand in determining what home loan brokers fee. Federal regulation limits exactly how high payment can go. 3. What makes home loan brokers different from finance police officers? Lending police officers are employees of one loan provider who are paid established wages (plus benefits). Funding police officers can write only the sorts of fundings their company selects to supply.

Some Known Factual Statements About Broker Mortgage Rates

Mortgage brokers might page be able to provide customers access to a wide option of finance kinds. You can conserve time by making use of a home mortgage broker; it can take hours to apply for preapproval with various lending institutions, after that there's the back-and-forth interaction involved in underwriting the funding and ensuring the transaction stays on track.imp source When selecting any kind of lender whether via a broker or directly you'll desire to pay attention to lending institution charges. Particularly, ask what charges will certainly show up on Page 2 of your Car loan Estimate kind in the Car loan Expenses area under "A: Source Charges." After that, take the Funding Quote you get from each lender, put them side by side and also compare your rates of interest and all of the charges as well as shutting expenses.

Broker Mortgage Near Me - An Overview

5. Exactly how do I pick a mortgage broker? The very best means is to ask close friends as well as family members for recommendations, however ensure they have really made use of the broker as well as aren't simply dropping the name of a former university roomie or a far-off colleague. Find out all you can about the broker's solutions, interaction design, degree of knowledge and also strategy to clients.

The 9-Minute Rule for Mortgage Broker Average Salary

Competition as well as residence costs will influence exactly how much home mortgage brokers get paid. What's the difference between a mortgage broker as well as a financing policeman? Funding policemans work for one lending institution.

What Does Mortgage Brokerage Do?

Investing in a new house is one of one of the most complex events in a person's life. Properties vary greatly in terms of style, amenities, college district as well as, certainly, the constantly important "location, area, place." The mortgage application procedure is a challenging facet of the homebuying process, especially for those without past experience.

Can figure out which concerns could create troubles with one loan provider versus another. Why some purchasers published here prevent home loan brokers In some cases homebuyers feel a lot more comfy going directly to a big financial institution to protect their funding. In that case, customers need to a minimum of speak with a broker in order to comprehend every one of their choices regarding the sort of funding and the readily available rate.

Report this wiki page